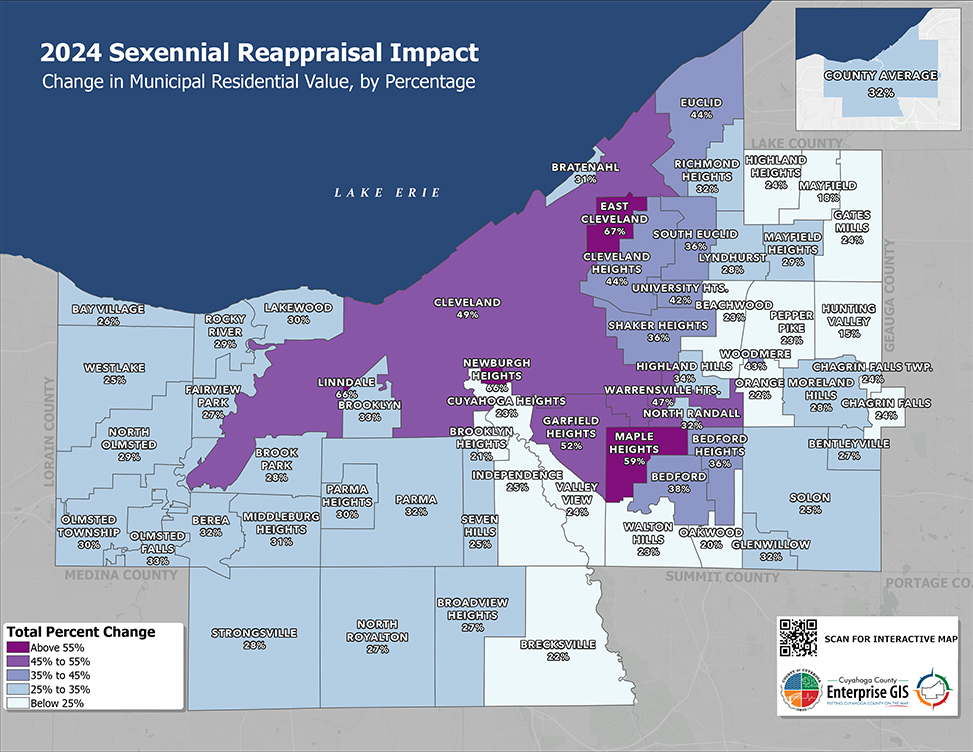

2024 Sexennial Reappraisal

Reappraisal Tax Estimator

Use the estimator to determine your 2025 tax bill payment for Real Property.

Estimate Tax2024 Sexennial Reappraisal Presentation

Presentation of the 2024 Sexennial Reappraisal Overview.

PresentationSexennial Informal Valuation Complaint Portal

File an Sexennial Reappraisal Informal Valuation Complaint online.

View PortalPurpose

Under Ohio State law and Department of Taxation rules, real property is reappraised every six years by state licensed appraisers. An increase in valuation does not mean your property taxes will increase.

Appraisal Process:

An appraisal is a professional opinion/estimate of value.

Property values are updated based on:

- Market estimate

- Neighborhood sales and new construction

- Proposed values per square foot

Complaint Process:

Residential property owners who want to contest their valuation have two options:

1. Informal Review filing deadline was August 30, 2024

Residents who filed for Informal Review will receive notification of any valuation adjustment in November.

2. Formal Tax Complaint January 1 – March 31, 2025

File a Formal Tax Complaint against the valuation of Real Property by one of the following ways:

- Electronically with a DTE Form 1 through the Cuyahoga County Board of Revision during the complaint filing period

- Via U.S. Mail, email (BORinfo@cuyahogacounty.us) or fax (216-443-8282)

- Delivered in person to the Board of Revision

Address:

Cuyahoga County Administrative Building

2079 E. 9th Street, 2nd Floor

Cleveland, Ohio 44115

When filing a Formal Tax Complaint the property owner must provide documents to support their opinion of value, which can include:

- A complete appraisal report from the last calendar year

- Dated photographs of the property, showing existing conditions

- Certified estimates from a contractor for repairs

- Purchase agreement with closing statement

- New construction costs certified by a builder (hard and soft costs)

Note: The Board of Revision will schedule a hearing. Property owners must provide evidence to prove their opinion of value.

Questions?

Fiscal Office

216-443-7420, option 3

Resources for Residents

- Homestead Exemption - Find out if you are eligible for this tax credit.

- Owner Occupancy Credit - Find out if you are eligible for this tax credit.

- EasyPay - A convenient way to pay property taxes.

- Military Deferment - Property taxes can be deferred.

- Property Alerts - Protect yourself from deed fraud.

- Neighborhood Map - Check the Average Proposed Value By “Neighborhood,” areas of similar housing types, age, and construction.

- 2024 Proposed Property Value File - Complete listing of Cuyahoga County current property values and tentative values from the Sexennial Reappraisal.

An official website of the Cuyahoga County government. Here’s how you know

An official website of the Cuyahoga County government. Here’s how you know